Bangchak Corporation Public Company Limited announced the strategy "Accelerating Bangchak 100x: Pivoting toward Energy Security and Sustainability", setting an ambitious target to double EBITDA by 2028. The strategy is designed to accelerate value creation and strengthen competitiveness, while sustaining excellence across all dimensions. Growth will be advanced through four strategic pillars, underpinned by financial discipline, the development and care of employees as the organization's driving force, and a steadfast commitment to balancing environmental, social, and governance (ESG) responsibilities to ensure sustainable long-term growth.

Mr. Chaiwat Kovavisarach, Group Chief Executive Officer and President of Bangchak Corporation Public Company Limited, stated:

"Bangchak has expanded its energy businesses from upstream to downstream, now operating in more than 10 countries worldwide. In 2024, total assets exceeded THB 316 billion, rising more than fivefold from approximately THB 59 billion in 2010. This achievement reflects the Company's ability to adapt, transition, and sustain growth within a relatively short timeframe."

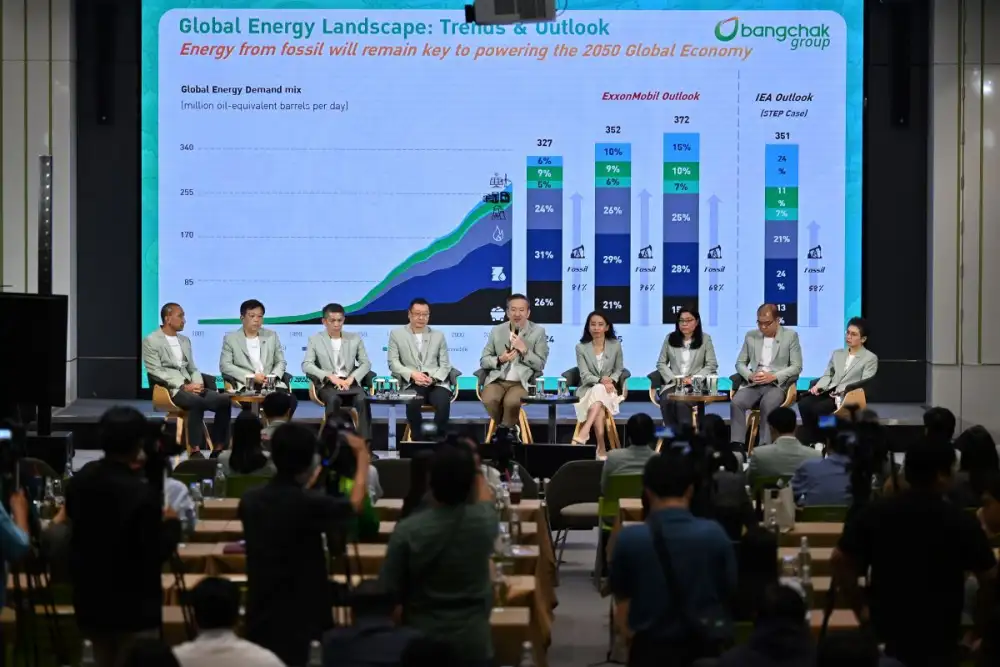

The Company is confronting increasingly complex challenges, driven by geopolitical volatility, energy price uncertainty, and the pressures of climate transition. While the global community is advancing decarbonization, several reports affirm that hydrocarbons will remain central to the world economy through 2050. In response, Bangchak is accelerating the Bangchak 100x strategy to secure resilient growth, with a strong emphasis on return-focused investment alongside international expansion. The Company is committed to creating value in its core businesses and ensuring disciplined capital allocation to maintain Top Tier TSR, consistently outperforming peers over the past five years, with aspirations to deliver even greater returns. At the same time, Bangchak continues to invest in the energy transition, preparing for a future driven by clean molecules - future-proof fuels that minimize carbon emissions into the atmosphere and provide a foundation for long-term sustainability.

The four strategic pillars comprise setting bold new targets to double EBITDA by 2028, while strengthening organizational capability to become Thailand's Top Employer and reinforcing leadership in sustainability by targeting Top 1% ESG Ranking and Top 5% in the DJSI, alongside continuously reducing carbon intensity; driving energy security and sustainability through return-focused investments in mid-life upstream assets, power, and new infrastructure; enhancing business capabilities and margins through portfolio restructuring and new investments across Refinery & Marketing, Biofuels and Future Fuels (SAF, HVO), and Asset-Backed Trading, with refinery capacity expansion, development of higher value-added products, extended marketing networks, and scaling up the Non-Oil business; and creating shareholder value through the launch of the Company's first three-year Share Buyback Program to enhance confidence in long-term growth potential.

To ensure sharper execution, Bangchak will restructure its businesses to reinforce long-term strength and unlock greater synergy, particularly across Refining, Marketing, and Biofuels. The Company will simultaneously accelerate new growth drivers in Trading and Upstream, reposition BCPG as a critical infrastructure operator to deliver both sustainability outcomes and stable income, and invest in future-proof technologies through a USD 30 million CVC Fund to keep the Group ahead of the curve.

Effective January 1, 2026, Bangchak will reorganize its operations into five core business groups:

- Refinery & Marketing and Biofuels - integrating Bangchak Phra Khanong and Bangchak Sriracha refineries under a One Team model to maximize efficiency and reduce costs, expanding refining capacity from 265,000 barrels per day in 2025 to 285,000 barrels per day by 2028, and over 290,000 barrels per day by 2030. Investments include 7,000 barrels per day of SAF and HVO capacity by 2027 (with SAF 5,000 barrels per day commencing commercial production in June 2026). In Biofuels, ethanol capacity will increase to 292 million liters per year from 2026, while biodiesel will reach full utilization at 330 million liters per year. The Company is also pursuing new opportunities such as Alcohol-to-Jet, Bio-LNG, and Waste-to-Energy.

In Marketing, Bangchak aims to expand its retail network to around 2,300 service stations by 2025 and exceed 2,300 by 2028, targeting oil market share growth from 29% in 2025 to more than 33% by 2030. The Non-Oil business, including Inthanin Coffee and Retail, is projected to triple EBITDA by 2028.

- Trading - established as a new flagship business, elevated from its prior supporting role to become a primary growth engine. The business will focus on asset-backed trading, leveraging the Company's refining, storage, and logistics infrastructure to expand market presence while managing price and volume risks, with the goal of increasing both trading volumes and value across domestic and regional markets.

- Upstream - targeting to become a leading operator of mid-life upstream assets in Southeast Asia, drawing on international expertise from Norway to enhance production efficiency, strengthen cash flow resilience, and ensure long-term energy security and growth through disciplined investments.

- Power and Infrastructure - expanding beyond renewables into critical infrastructure investments, including data centers, essential infrastructure systems, and battery recycling. The Company targets EBITDA of THB 7 billion by 2028 through portfolio optimization and capital recycling to generate higher returns.

- New Businesses and Holdings - driving growth through both expansion of core businesses and new investments, including a USD 30 million commitment to emerging technologies. This group will focus on enhancing operational efficiency, advancing digital transformation, and developing next-generation clean energy such as Bio-LNG, Nuclear Fusion, Green Ammonia, and synthetic fuels, alongside biotechnology and advanced battery systems, to strengthen the Group's core businesses, capture new opportunities, and deliver sustainable growth.

The Company's financial strategy emphasizes four priorities: enhancing margins through efficiency improvements and effective CAPEX allocation; return-focused investment prioritizing Upstream, Trading, and Critical Infrastructure as primary growth drivers; delivering superior shareholder returns through a three-year share buyback program and sustainable dividend payouts; and preparing for the future by advancing the energy transition and harnessing new technologies while maintaining financial strength under rigorous investment discipline. CAPEX of THB 35 billion has been allocated for 2026-2028 to reinforce core businesses, expand into future infrastructure, and support sustainable growth.

"Bangchak must move forward with urgency and discipline, preserving the strength of its core businesses, sustaining excellence across all dimensions, and balancing energy security with the transition to sustainability. With a clear commitment to achieving Net Zero by 2050, the strategy 'Accelerating Bangchak 100x: Pivoting toward Energy Security and Sustainability' has been designed to address every dimension, creating enduring value for stakeholders, shareholders, and society," Mr. Chaiwat concluded