KTC reports a 20.1 percent net profit growth or 3,352 million baht for the first half of the year, announcing a net profit of 1,703 million baht for Q2/2021. This was achieved despite the impact of the third wave of the COVID-19 outbreak. The Firm applied past experience to adjust business strategies to cope with the situation. Hence, the overall operation is well managed. Total loans to customers and accrued interest receivables increased while NPL remained at a similar level. The Firm is ready to move forward in the second half of the year to expand into offering a full-service collateral loan business, maintain its member base, manage the value of accounts receivable portfolio, help those suffering from COVID-19 in a joint effort with various charities, and extend its relief package period to help retail debtors until December 31, 2021, according to the measures implemented by the Bank of Thailand.

Mr. Rathian Srimongkol, President & Chief Executive Officer, "KTC" or Krungthai Card Public Company Limited, states, "The overall consumer finance industry in the past six months of this year continued to grow. Generally speaking, KTC's business operations are still going well amidst the uncertain economic conditions as a result of the new wave of the COVID-19 outbreak. The Company used its experience as an organizational compass to adjust strategic plans to combat situations that had arisen. By the end of May 2021, the Company's credit card receivables grew at a rate of 10.4 percent (compared to industry growth of 8.6 percent). Consequently, KTC attained a credit card receivables market share at 13.7 percent, an increase from the same period in 2020 by 13.5 percent. The level of credit card spending increased by 5.4 percent (compared to industry growth of 2.2 percent) and personal loan receivables market share was 4.7 percent."

"However, the consecutive third wave of the coronavirus has affected the purchasing power, and landing of new cardmembers has become more difficult. Additionally, the total port of receivables and the level of credit card spending did not experience significant growth. KTC, therefore, rolled out a plan to expand its business model to cover more secured loans. The Firm acquired 75.05 percent shares of Krungthai Leasing Company Limited (KTBL) at the end of May 2021. After the audit completion that is set to happen in November 2021, KTBL will become one of KTC's subsidiaries."

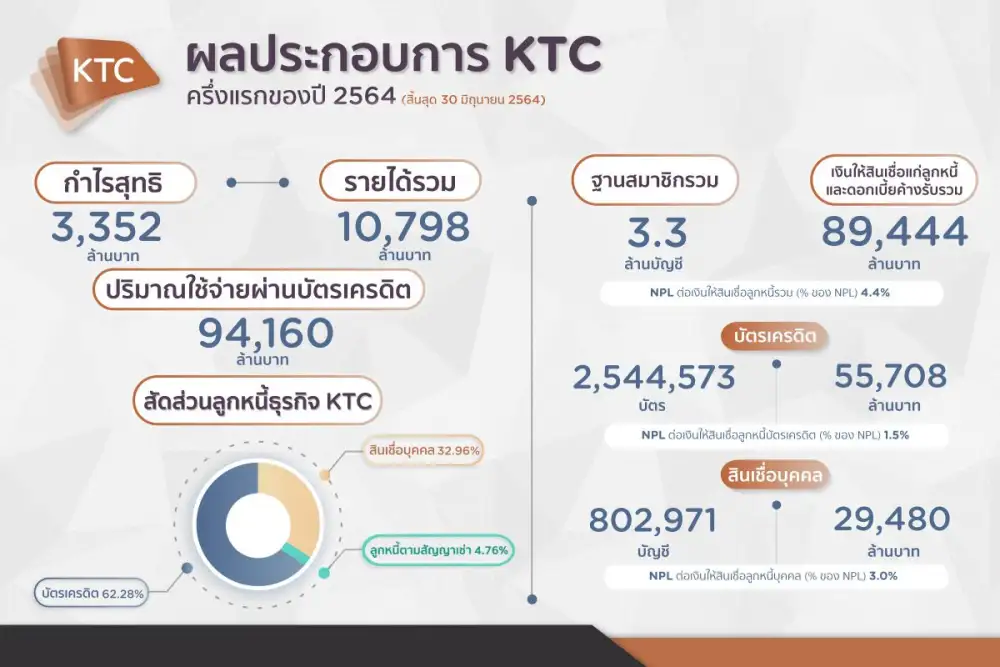

"Regarding the Company's performance as of June 30, 2021, compared to the same period in 2020, KTC has a net profit of 3,352 million baht in the first half of the year, a growth of 20.1 percent, and a net profit of 1,703 million baht for Q2/2021, a spike of 48.2 percent. Although the Firm saw a decrease in total income, it managed to maintain the total cost at a lower level by lowering financial costs and expected credit losses. Bad debt recovery was recovered at a better level while the NPL ratio was maintained at the same level as before amid many variable factors. Due to these aforementioned factors, KTC's ratio of total operating expenses to revenue increased slightly and profit before expected credit losses decreased by 5 percent year-on-year. Port of receivables remained at a high quality and further helped eliminate the need to set an allowance for expected losses, which led the Company's net profit to grow in the proportion set forth above in the second quarter."

"Total loans to customers and accrued interest receivables totalled 89,444 million baht (a 7.1 percent growth) compared to last year. Total database accounts numbered 3.3 million, comprising 2,544,573 credit cards. Total loans to credit card debtors and accrued interest receivables are at 55,708 million baht. The total credit card spending for the first half of the year was 94,160 million baht, an increase of 3.9 percent (the value in the second quarter was 45,739 million baht, an increase of 13.1 percent). NPL to total loans totalled 4.4 percent, a growth from 1.9 percent compared to Q1/2021 mainly due to the inclusion of the total portfolio of hire purchase receivables from KTBL, coupled with the COVID-19 outbreak that resulted in the impairment of the debtors' ability to pay. The NPL to credit card loan receivables is 1.5 percent. KTC's port of personal loans amounted to 802,971 accounts. Loans to personal loans debtors and total accrued interest receivables amounted to 29,480 million baht, and NPL for the personal loans business totalled 3.0 percent. The port of lease receivables is 4,255 million baht, and the NPL per lease receivable is 51.7 percent."

"Furthermore, in Q2/2021 the company accumulated a net income at a similar level compared to last year at 5,406 million baht. This can be broken down into a total interest income (including credit line usage fee income) of 3,430 million baht (1,639 million baht from the credit card business, 1,766 million baht from personal loans, and 25 million baht from interest income from KTBL lease receivables), which decreased by 5.6 percent due to trim on the interest ceiling down to 16 percent. Income from fees (excluding credit usage fees) totalled at 1,042 million baht, a 7.6 percent increase, stemming from income from interchange fees, income from discount fees collected from the growth of 42,625 in KTC member merchants that support credit card payments, and an increase in income from advance cash withdrawal fees. Despite this, the debt collection fee has been reduced. Bad debt recovery was recovered by 833 million baht (an increase of 19.3 percent) and 100 million baht for other income. The total revenue for the first half of 2021 was 10,798 million baht, a decrease of 2.5 percent compared to the same period last year. Overall expenses in Q2/2021 was at 3,278 million baht, a 17.3 percent decrease, comprising of 1,144 million baht in expected credit losses (a 45.1 percent decrease), 359 million baht in financial costs (a 5.3 percent decrease), and 1,775 million baht in total operating expenses (an increase of 18.3 percent). The Firm has an available credit line of 22,330 million baht, while financial costs are at 2.62 percent, debt to equity ratio is at 2.45, which is 10 times lower than the covenant."

"In light of the spread of COVID-19 which remains unpredictable, a widespread of new clusters, and a rapid increase in the number of daily infections, the Company has extended the relief period for member debtors who are affected by COVID-19 to apply for credit assistance until December 31, 2021, as well as to continuously support the Bank of Thailand's measures. There are a total of 21,564 debtor accounts that participated in this assistance measure, with a remaining debt balance of 1,545 million baht. In addition, the Company has also cooperated with charities to carry out various activities to help those in need. For example, a points donation project with KTC cardmembers that converted KTC FOREVER points into cash donations to purchase COVID-19 relief bags to distribute to those who had to self-quarantine for 14 days via The Thai Red Cross Society, a donation project that supported the purchase of medical equipment to treat patients via Ramathibodi Foundation, Siriraj Foundation, and Rajavithi Hospital, and the "Convert Hearts to Merit" activity which converted stickers sent by "KTC Journey" page members into cash donations to purchase medical equipment and take care of the sanitation of employees to prevent the spread of the epidemic."

"In terms of KTC's business operation direction in the remaining half of 2021, the Company will expand the scope of its credit business to be more diversified to cover KTC P BERM and leasing businesses. The Firm will aim to become the leader in the fully integrated and comprehensive loan business that prioritises the needs of customers to generate customer satisfaction. This includes the maintenance and upkeep of the existing member base to remain satisfied. The key goals in conducting business are as follows: achieve 200,000 million baht worth of credit card spending in 2021 or an expansion of 5 percent, an adjustment from the previous projection of an 8 percent growth, manage the value of personal loan receivables at a similar level to 2020, and a loan target of 1,000 million baht for "KTC P BERM" collateral loans, including loans from Krungthai Leasing Company Limited. On merchant acquiring, the Firm will focus on online channels through cooperation with partners."