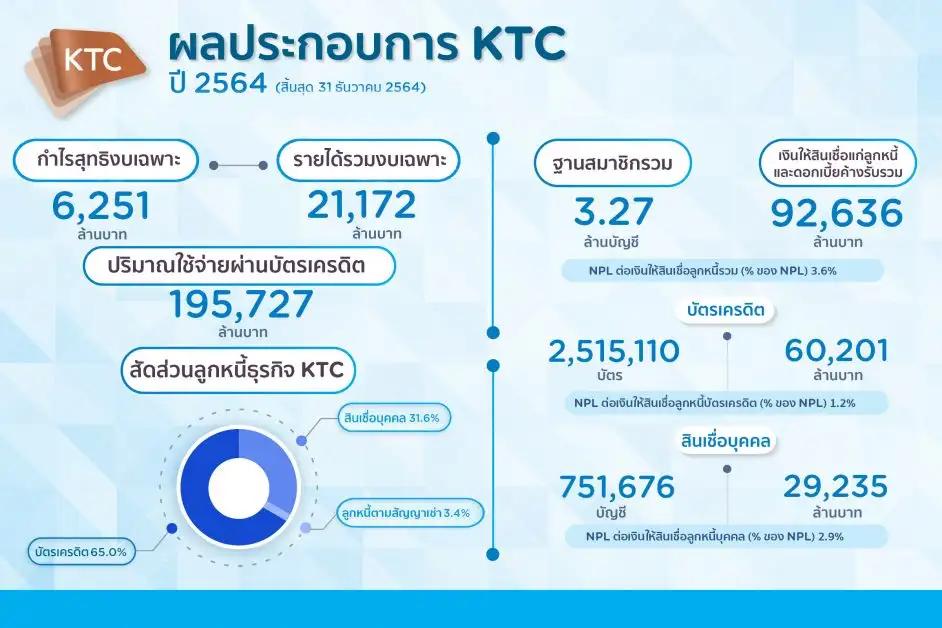

KTC is satisfied with its 2021 separate financial statement earnings, having set a new record once again at 6,251 million baht or a growth of 17.2 percent. The total port of receivables did not grow as much as it should as a result of the COVID-19 crisis and the continuous lowering of the interest ceiling on credit card and personal loans. In 2022, KTC has its sights set on capitalizing on the recovering economic momentum which signals better consumer spending to create growth opportunities for the secured loan business. KTC sets a target to push the total portfolio to grow more than 100,000 million baht and to strike gold again with a new-high profit in 2022.

Mr. Rathian Srimongkol, President & Chief Executive Officer, "KTC" or Krungthai Card Public Company Limited, states, "Overall, the Thai economy has slightly improved in 2021 in response to the easing of COVID-19 control measures which caused the operations of many businesses in the private sector to have a tendency to improve. There was also domestic spending which in turn generated circulating funds from tourism, and product and service export. However, we still need to keep an eye on the risks of household and business debt in 2022 that remain at high levels and keep a lookout on the emergence of the Omicron COVID-19 variant that is spreading rapidly in many areas, affecting domestic consumption and causing a decrease in the number of foreign tourists."

"In the past 2-3 years, KTC has been continuously affected by COVID-19 and the lowering of the interest ceiling on loans, causing the slowing down of some business expansion plans and limited the growth of the total debtor portfolio. Therefore KTC had to adjust several strategic plans for the business to get through these crises. These changes include continually managing the portfolio of receivables to be of high quality and cost control. These are the main factors that contributed to the growth in KTC's net profit in 2021. This once again sets KTC a new record for the highest profitability, or 6,251 million baht in separate financial statements and 5,879 million baht in consolidated financial statements resulted in an increase of 17.2% and 10.2% respectively. The profit in the consolidated financial statements was lower than the separate financial statements as the actual trading price of KTB Leasing Company Limited (KTBL) was lower than expected. Furthermore, to reflect the real value of the debtor portfolio, the provision was increased in KTBL in the amount of 539 million baht, which was a one-time transaction."

"Regarding KTC's performance as of December 31, 2021, the Company has total loans to customers and accrued interest receivables of 92,636 million baht, or a 2.8 percent growth compared to last year. The total credit card spending for the entire year was 195,727 million baht, a decrease of -0.7 percent. Total revenue was 21,442 million baht, a decrease of -2.8 percent, due to a decrease in interest income from credit card and personal loan receivables as a result of the reduction of interest rate ceiling of both businesses and the impact of the COVID-19 pandemic. However, KTC was able to manage total expenses to decrease by -7.8 percent to 14,197 million baht. The financial costs and expected credit losses dropped by -7.7 percent and -17.4 percent, respectively, with a 4.7% percent increase in the bad debt recovery rate. The total non-performing loan (NPL) ratio decreased to 3.6 percent from 3.8 percent in the third quarter."

"KTC's total portfolio of receivables at the end of 2021 numbered 3,266,786 accounts, comprising of 2,515,110 cards in the credit card business, and loans to credit card debtor balance of 60,201 million baht. The non-performing loans to total loans ratio (NPL) for credit card debtors is at 1.2 percent. This also includes 751,676 accounts in the personal loans business. Loans to personal loans debtors amounted to 29,235 million baht and the non-performing loans to total loans ratio (NPL) for personal loans debtors totalled 2.9 percent."

"KTC also prioritised efficient financial cost management. By the end of 2021, the Company had total borrowings of 54,403 million baht, a decrease of 5.3 percent. The structure of the source of funding can be broken down into short-term and long-term borrowings accounting for a ratio of 17 percent to 83 percent respectively, of which 6,230 million baht was borrowed from Krungthai Bank, 4,400 million baht from other financial institutions, and 43,773 million baht in debentures. Cost of funds is at 2.5 percent, debt to equity ratio is at 2.3 times, well below the bond covenant limited at 10 times. Additionally, KTC has an available credit line of 24,009 million baht."

"For the strategic plan in 2022, KTC foresees an opportunity for the growth of secured loans that have been laid out for more than two years. On the same note, KTC anticipates better economic recovery, the government to implement stimulus measures, and consumers to start to spend more. Given these reasons, KTC is confident that it will be able to drive the total debtor portfolio to grow over 100,000 million baht and achieve an all-time high that sets a new record again in 2022. KTC has allocated more marketing budgets and set a different key business model in motion to support this plan. For the credit card business: create an opportunity to increase market share by expanding the card base jointly with major partners. Expect new product launches and the development of co-branded credit cards that emphasise the right benefits to establish long-term connections with cardmembers. The credit card spending amount target is a 10 percent growth or about 220,000 million baht. Meanwhile, KTC P BERM and KTBL will be the core businesses aimed to create a new S curve that will drive KTC's revenue to grow sustainably. The loan target growth is 11,500 million baht and will be executed through cooperation with Krungthai Bank and KTBL networks nationwide. Lastly, the personal loan business will focus on expanding new member base in potential groups, focusing on those with regular income and have a higher income base. Target growth rate is approximately 7 percent."

"MAAI BY KTC is KTC's latest state-of-the-art platform that is an extension of KTC's strengths, namely the execution of its reward point system and expertise in managing KTC FOREVER points that meet a variety of customer needs. It will offer services to business partners who want to utilize an integrated loyalty program that features Membership Management, Point System Management, and e-Coupon Management solutions."

"KTC has always operated and complied with all of the Bank of Thailand's guidelines and measures that support debtors. This includes assisting debtors who participated in converting credit card debt and personal loans into long-term personal loans. As of December 31, 2021, the value of loans to debtors is 1,998 million baht (29,169 accounts). Debtors who received assistance through KTC accounted for approximately 2.15 percent of the total debtor portfolio."