The US Federal Open Market Committee (FOMC) meeting outcome reflected that the Federal Reserve (Fed) needs to keep inflation within the target within the next two years, which triggered its counterparts to accelerate policy rate hikes. A string of interest rate hikes has dealt a big blow to the global economy, especially tightening liquidity and financial conditions. The rising global borrowing costs could slow down global economic growth which affects the recovery of exports and tourism-dependent emerging market countries and compels them to resort more to domestic spending and stimulus measures.

Stock Exchange of Thailand (SET) Senior Executive Vice President Soraphol Tulayasathien said that the US dollar upward trend continuously weakens ASEAN currencies, including the Thai baht. However, in the first nine months of 2022, an influx of capital flows to the Thai stock market was significant and SET Index's volatility remained low compared to other stock market indices, whereas the uncertainty from the impact of global economic policy started to escalate.

Key highlights for September

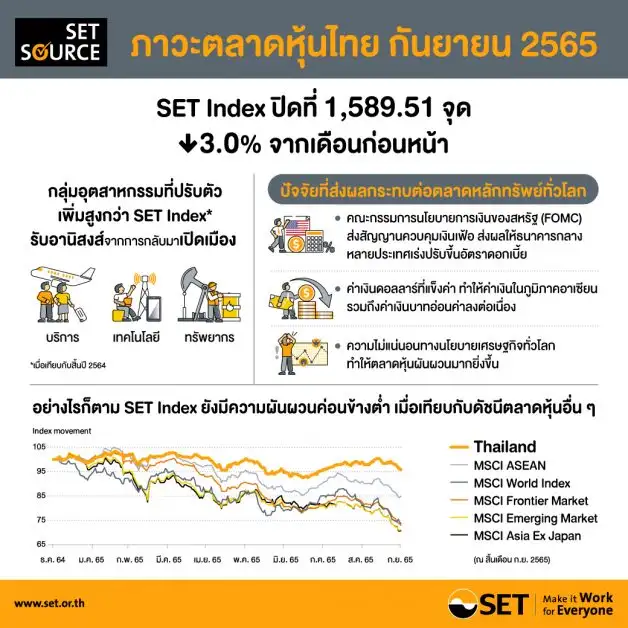

- At end-September 2022, SET Index closed at 1,589.51 points, down 3.0 percent from the previous month, moving in tandem with indices of other stock exchanges in the region. From the end of 2021, SET Index decreased by 4.1 percent.

- In the first nine months of 2022, SET Index was driven by industries that benefited from the country's reopening. Compared to the end of 2021, Services, Technology, and Resources industry groups outperformed SET Index.

- In September 2022, the average daily trading value of SET and Market Alternative for Investment (mai) amounted to THB 75.09 billion (approx. USD 2.01 billion), down 25.5 percent from the same month a year earlier. In the first nine months of 2022, the daily trading value averaged THB 81.82 billion. In September 2022, foreign investors were net sellers of THB 24.27 billion, reducing foreign investors' net buy to THB 146.4 billion in the first nine months of 2022. Foreign investors grabbed the biggest slice of trading value for the six consecutive months.

- In September 2022, three securities listed on SET, namely Charoen Industrial pcl (CH), Thai Eastern Group Holdings pcl (TEGH), and Bangkok Airport Leasehold Real Estate Investment Trust (BAREIT). The Thai stock market are among the leading initial public offering (IPO) venue in Asia in 2022.

- The Thai stock exchange's forward P/E ratio at end-September 2022 was 15.3 times, higher than the Asian stock markets' average of 11.5 times. The historical P/E ratio stood at 16.1 times, above the Asian stock markets' average of 12.1 times.

- Dividend yield ratio at end-September 2022 was 2.90 percent, below the Asian stock markets' average of 3.30 percent.

Derivatives market

- In September 2022, Thailand Futures Exchange (TFEX)'s average daily trading volume was 677,673 contracts, an increase of 36.5 percent from the preceding month, significantly driven by the increase in Single Stock Futures. During the first nine months of 2022, TFEX's average daily trading volume totaled 564,624 contracts, or a 2.6 percent increase from the same period a year earlier.