Cambodia's Hattha Bank, a wholly-owned subsidiary of Krungsri (Bank of Ayudhya PCL), is accelerating its shift to online banking services to meet increased demand and changing business and consumer needs as the country's economy recovers from the COVID-19 pandemic.

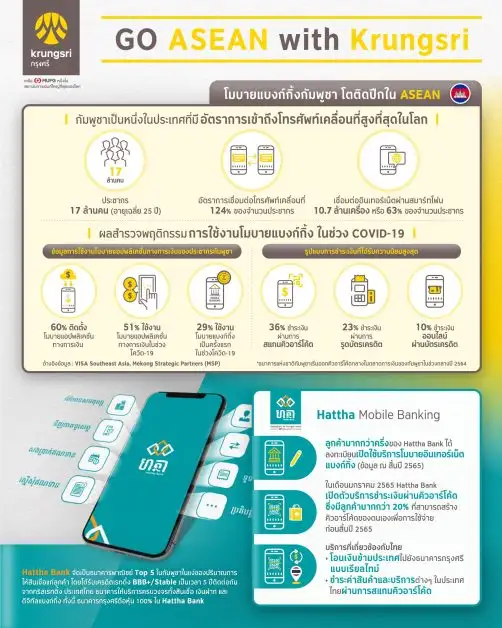

At the end of 2022 over half of Hattha Bank's clients had registered for mobile internet banking in response to the increased use of digital payments and money transfers in Cambodia. In 2021, QR code payments increased by over a third to become the top digital payment method used in the country (36%), overtaking physical card payments (23%) and online card payments (10%).

In addition to digital payments, Hattha Bank mobile banking customers will also be able to makecross-border fund transfers to Krungsri in Thailand and pay for products and services in Thailand via QR payment.

"With one of the youngest populations in Southeast Asia, high smartphone and internet penetration, and a rapidly growing financial services sector, Cambodia has a great foundation for blossoming digital economy. Introducing value-added mobile banking services will create opportunities for the country's 500,000 micro, small and medium enterprises (MSMEs) that will benefit from faster and more convenient ways to accept payments and make transfers. We expect mobile banking to meet the needs of Cambodia's growing middle class and increasingly affluent consumers, while also supporting business growth," said Mr. Pairote Cheunkrut, Krungsri Chief Strategy Officer.

The growth of online marketplaces and the familiarity of digital payments among Millennials and Gen Z are accelerating mobile payment adoption in Cambodia. The pandemic saw more than a quarter (29%) of Cambodians use mobile banking for the first time. In mid-2021, the National Bank of Cambodia (NBC) began to centralize QR codes in the Cambodian financial market, and in January 2022 Hattha Bank launched QR payments with over 63,000 customers creating their own QR code by end of 2022.

Areas of opportunity for consumer consumption and digital banking adoption include:

- The food and beverage (F&B) sector, along with electronics, education, and transport.

- Introduction of new services such as tele-medicine services and education technology (EduTech)

- New business models including subscriptions, renting and sharing will accelerate.

- Retail omni-presence demand with consumers preferring both online and offline commercial presence.

- Growth of healthy and environmentally sustainable services

- The growth of super-apps providing one-stop services

"All across the region consumers are adopting increasingly digital lifestyles. As a leading digital bank with regional presence, Krungsri is ideally placed to help people and businesses across ASEAN connected via a strong financial network and give entrepreneurs, businesses and consumers more opportunities to buy, sell and do business together. Seeing the digital banking and payments landscape develop in Cambodia is good news for consumers and business both in Cambodia and Thailand, and we aim to play a pivotal role in growing the economy of each country," said Mr. Pairote.

Cambodia's population of around 17 million has a median age of just 25, while it has one of the highest mobile penetration rates in the world, with 20.8 million mobile connections, or 124% of the population. There are 10.7 million smart phones connected to the internet, driven by some of the cheapest rates in the region.